Looney added that BP is not doing renewables for the sake of it or for the “spin,” but rather to create the integrated offering of “firm, clean, affordable” power — a further indication of how BP’s activity in the power sector could look.

In 2000, BP launched its 'Beyond Petroleum' campaign and began investing in wind and solar. Momentum dropped after the departure of Lord Browne as CEO in 2007. The company divested from solar in 2011 and wind in 2013.

A big future for Lightsource BP

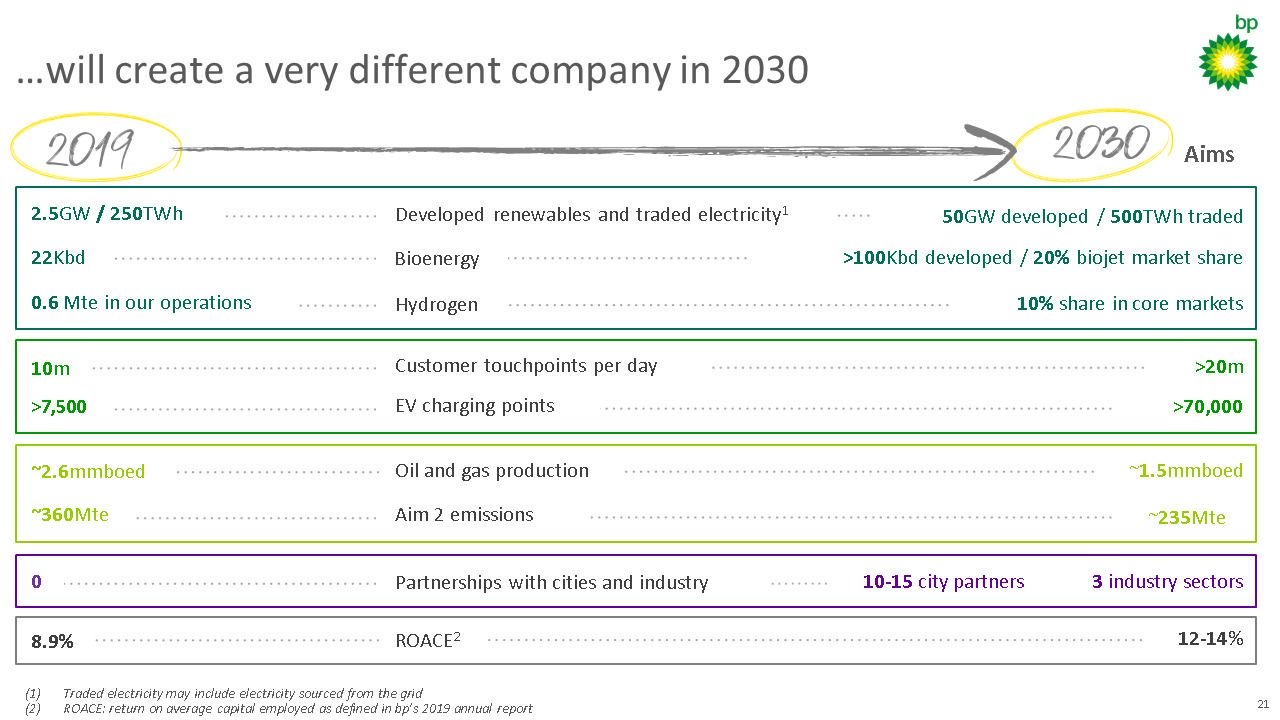

BP's new 2030 targets offer important clues as to how it will invest over the next decade.

Renewable energy generation capacity will increase from 2.5 gigawatts at the end of 2019 to 50 gigawatts, with 500 terawatt-hours “traded.” Much of that capacity will come throughLightsource BP, the global solar developer in which BP holds a 50 percent stake. At the end of 2019, Lightsource BP had a pipeline of 12 gigawatts.

BP officials said the company will add gigawatts with the right rate of return and won't simply add them for the sake of growing the volume. Capacity growth could be done through acquisitions but Looney said that is not “front of mind” in strategic planning.

BP will grow its electric vehicle charging points from 7,500 today to 70,000 by 2030. It also wants to build 10 to 15 “energy partnerships” with major cities and across three core industries, supplying the power in-house where possible.

Bioenergy production will be increased fourfold to 100,000 barrels per day, and BP wants a 10 percent market share in the hydrogen economy in each country where it will be active. BP’s hydrogen strategy will include both green and blue varieties, with heavy transport a focus in the U.S. and exports in Australia.

Giulia Chierchia, BP's executive vice president for strategy and sustainability, said green hydrogen is a potential route to establishing an “e-fuels” market.

Carbon offsets

BP has been upfront about the ongoing role of fossil fuels in its long-term plans. To reach net-zero, it will use carbon-capture technology and natural climate sinks such as forests to offset the emissions it can’t eliminate. The company has moved further on its net-zero planning than any of its competitors, but critics continue to look for a faster shift away from fossil fuels.

Mel Evans, senior climate campaigner for Greenpeace U.K., called Tuesday's announcements a "necessary and encouraging start" but said there is still much more to do. “Slashing oil and gas production and investing in renewable energy is what Shell and the rest of the oil industry need to do for the world to stand a chance of meeting our global climate targets. BP must go further and needs to account for or ditch its share in Russian oil company Rosneft,” Evans said in a statement.

BP's Chierchia stressed the importance of the role fossil fuels would have in paying for the company’s pivot to a low-emissions future. “Hydrocarbons are a key part of the strategy; they enable the strategy. They’re likely to be the key source of earnings in the coming years,” she said.

BP has now provided many — though by no means all — of the details critics demanded in February. Wood Mackenzie’s Parker says the new strategy is significant.

“We said back in February that no company of BP’s stature had gone as far, or committed so unequivocally, to transforming itself in the face of the energy transition," Parker said.

"The guidance that BP laid out today brings that transformation to life [and] makes it real. It constitutes the clearest and most detailed roadmap to 'Big Energy' that any of the Majors have provided to this point."

4 August 2020

gtm