Poland: PZU’s stance on coal makes no sense either for Paris Agreement or for its shareholders

From environmental and business perspectives, PZU still insuring coal is at odds with its share price - and its peers

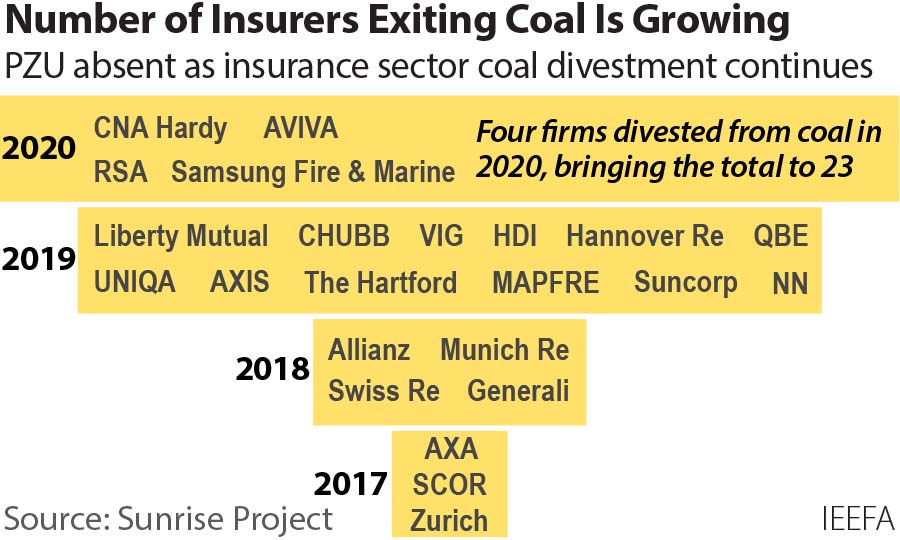

Poland’s largest insurer, PZU, stands out among European insurers — for the wrong reason. It is conspicuous in still insuring coal when almost all of its European peers are exiting coal.

This action goes against all of the objectives of the UN Paris Agreement to phase out fossil fuels by 2050. We know that this doesn’t make sense from an environmental perspective, but does it make sense from a business perspective?

I was a stock market analyst for 20-plus years, specialising in European insurers, and in my opinion, the answer is a resounding “no” for two reasons.

First, PZU’s pro-coal stance is potentially damaging for its share price because it goes against the rising tide of environmental awareness not only in the European insurance industry but also among investors and regulators/central banks.

European insurers have begun to change. Companies like AXA, Allianz, Generali, Zurich, Swiss Re and others have stopped underwriting new coal projects and are also exiting existing ones as fast as contracts permit. For example, France’s AXA went further recently and severed all of its ties with the major German utility company, RWE, precisely because it thought they weren’t doing enough to shut down their coal mines.

Investors are also changing their views. They are increasingly alert to climate risk as a potential impact on share prices. ESG investors have long argued for this, but now this view is no longer niche. For example, stock market analysts, such as those at French bank Société Générale, have started to factor environmental and ESG issues into all of their company valuations.

Regulators and central banks are also changing. A good example of this is the work of the Network for Greening Financial Services (NGFS), a 95-member global body of central banks and regulators set up in late 2017 and working to align the global financial system with the goals of the Paris Agreement.

At the moment, PZU’s share price can get away with its insurance of coal because investors are still not yet fully differentiating between insurers on green issues. But this won’t last long. The wind of change is blowing and PZU would be foolish to ignore it.

For another critically important reason, PZU (formally, Powszechny Zakład Ubezpieczeń) should not be insuring coal. And it’s one closely related to my heart as a former stock market analyst. Over the years I was often asked: what is the most important performance measurement that drives insurance company share prices? And my answer was solvency ratios.

PZU solvency ratio under threat

A solvency ratio is a measure of capital strength. In simple terms, a ratio of 100% is a basic requirement. The higher the ratio, the stronger the company. Typically, the solvency ratio is a good catch-all measure of performance. To have a high ratio, a company has to be profitable and managing its balance sheet in a prudent way.

I wholeheartedly agree with PZU that its solvency ratio of 223% is something to be proud of, but that’s not the end of the story. I’ve read its statements about climate change and there’s one thing that really stands out.

PZU says its own analysis suggests that if the Paris Agreement’s 1.5 degree Celsius temperature increase target is breached, then it will be bad for its solvency ratio. This is because of the likely higher incidence of unexpected natural catastrophes (like flooding, wildfires, crop failures etc) which will cost more money than it’s currently budgeting for.

PZU doesn’t quantify this, but it clearly says it will be bad. Given that this is the most important ratio driving insurance company share prices, shouldn’t PZU be more worried about this? I think so.

As the largest Polish insurer, I admit, PZU has a difficult legacy position to defend and develop. It also has to contend with the Polish state having a 34% stake, and the Polish state is one of the worst offenders in the world in still supporting coal. Indeed, PZU’s stance on coal could be dictated more by the Polish state than by its own choice.

Apart from their coal policy, I’m really impressed with many of the things PZU is doing to better manage its insurance business. For example, it’s using big data and AI to improve risk management and claims handling, as well as trying to implement more rigorous needs-based client segmentation.

PZU is doing a lot of good things, and its share price has performed well since its dramatic fall in October last year.

However, on the subject of coal insurance, the insurer desperately needs to wake up and smell the coffee — or in its case, the carbon dioxide fumes.

It’s time to join its peers and exit coal.

IEEFA guest contributor Nick Holmes was an equity analyst and is a former Managing Director and Head of Insurance at Société Générale Investment Bank.

This commentary was first published in Gazeta Ubezpieczeniowa.

18 November 2021

IEEFA