Sustainable investing: no longer just an equity game

Investors are stepping up to embrace Sustainable Development Goal Strategies. Read how Detailhandel evolved its fixed income approach with SDGs in mind.

Sustainable investment is an equity story, isn’t it? After all, it’s only shareholders who have voting rights. The power of the corporate ballot enables investors to exert pressure on companies to improve their environmental, social and governance (ESG) standards.

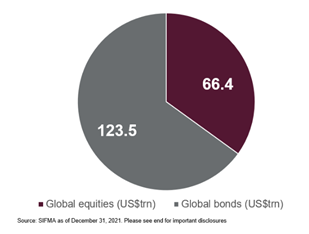

But the global fixed income markets are almost double the equity markets in size. As substantial providers of capital to corporations, bond investors carry obvious sway over company managers’ strategies and policies, including those on sustainable development.

In fact, global fixed income investors are not far behind equity investors in implementing sustainability considerations within their portfolios.

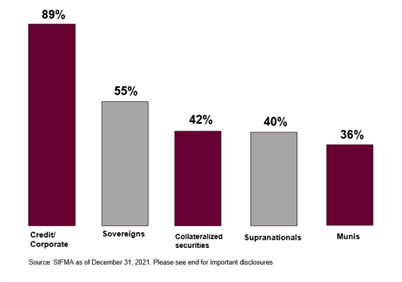

35 percent of asset owners now invest sustainably in bonds, compared to 46 percent of those investing in equities (these figures are from the 2021 FTSE Russell survey of 179 global asset owners, nearly half of whom had over $10bn in assets under management).

In Europe, the Middle East and Africa the proportion of fixed income investors using a sustainable approach rises to half of those surveyed by FTSE Russell.

For those institutions following this path, it’s corporate bonds and sovereign debt that are the primary area of focus.

Incorporating sustainability

But how does this work in practice?

We can incorporate ESG factors into fixed income investment strategies using three approaches: by means of integration, via constituent screens or by focusing on a theme.

In corporate bonds, for example, integration means incorporating material ESG factors in credit research and analysis.

In sovereign and sub-sovereign debt, integration means taking into account key social and environmental factors, such as inequality, climate-related risk and the energy transition.

Screening means applying filters to lists of potential investments, ruling issuers in or out of contention for investment based on an investor’s preferences, values or ethics.

Thematic investing means selecting issuers that address sustainability challenges, or securities that fund sustainability projects (in fixed income, green bonds are an example of this approach).

Forward-thinking asset owners are now taking the lead in aligning their fixed income portfolios with global sustainability standards.

One of the pioneers is the Netherlands’ Pensioenfonds Detailhandel, the collective pension scheme for the Dutch retail industry.

In 2021 Detailhandel decided to align its fixed income assets, starting with the credit portfolio, with four of the United Nations’ 17 sustainable development goals (SDGs). In the previous two years, the pension fund had taken similar steps with its developed and emerging markets equity portfolios.

Detailhandel has invested €3bn in a portfolio managed by BlackRock and tracking a new FTSE Russell benchmark, the FTSE EuroBIG excluding-Sovereigns SDG index.

This is a custom index of corporate, sub-sovereign and collateralised bonds, designed to integrate the four UN SDGs prioritised by Detailhandel:

- SDG 8 – Decent work and economic growth

- SDG 12 – Responsible consumption and production

- SDG 13 – Climate action

- SDG 16 – Peace, justice and strong institutions

For listed corporate and covered bonds, the index follows FTSE Russell’s sustainability framework for listed equities (the data inputs cover company ESG scores, green revenues and carbon performance).

For sub-sovereign bonds, the index uses a customised country-level ESG scoring system based on the alignment of a group of indicators with each of the desired SDGs, then tilts towards the desired index constituents.

Additionally, the index uses a green and impact bond overlay. This rewards the issuers of green and social bonds by means of an additional tilt factor.

We can measure the combined effect of these changes by comparing the SDG bond index with the starting benchmark, the FTSE EuroBIG ex-Sovereigns index, in which bonds are weighted by their market value.

Compared with the reference benchmark, a November 2020 simulation of the SDG index’s methodology showed a 62 percent reduction in CO2 emissions, a 69 percent reduction in carbon intensity and a 64 percent reduction in carbon reserves for the index’s corporate bonds. The new index also doubled the starting index’s green bond exposure.

Moving beyond equities

2021 marked the 20th anniversary of one of the best-known sustainable equity indexes. The FTSE4Good index series, launched in 2001, uses transparent metrics of ESG performance to select its constituents, incentivising companies to improve their sustainability practices.

But it’s clear that sustainable investment has now moved far beyond an equity-only approach.

Pensioenfonds Detailhandel’s initiative is a prototype for sustainable fixed income investing and serves as an example of intelligent product development. Others are following close behind.

Quite a few pension funds are now following the same route, more or less but because we had already started this custom SDG benchmark process back in 2018, we are now in a position to use that knowledge and experience to focus on benchmarks in more complicated asset categories.

Other funds are starting with equities as we did. If I look back at that exercise, which we undertook a few years ago, that was the relatively easy part.

We’ve now moved on to fixed income. Integrating SDGs in passively managed portfolios is a topic that’s getting more and more traction.

We’re very glad we teamed up with FTSE Russell and BlackRock in this space.

Detailhandel is now working on exploring the possibilities to extend the SDG-aligned approach to its emerging market debt portfolios (both domestic and foreign currency), its listed real estate and its high-yield portfolios.

We are ambitious and looking forward to see if we can establish some more custom benchmarks in 2022.

To learn more about FTSE Russell click here.

Henk Groot, Head of Investments, Detailhandel.

As published in a FTSE Russell blog

© 2022 London Stock Exchange Group plc (the “LSE Group”). All information is provided for information purposes only. Such information and data is provided “as is” without warranty of any kind. No member of the LSE Group make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance. No member of the LSE Group provide investment advice and nothing contained in this document or accessible through FTSE Russell products should be taken as constituting financial or investment advice or a financial promotion. Use and distribution of the LSE Group data requires a licence from an LSE Group company and/or their respective licensors.