BNEF predicts slow-down in clean energy economy due to Covid-19.

According to the latest data released by Bloomberg New Energy Finance (BNEF), it appears likely that the coronavirus outbreak will be a significant global crisis, triggering an economic slowdown.

In the report, Covid-19: Impact on Clean Energy, Transport and Materials, BNEF highlights some of the likely effects over the next year on the transition to a clean economy – including renewable power, energy storage, electric vehicles, heating, cooling and the circular economy.

Here we take a look at some of the key impacts identified in the report.

Macroeconomic impacts

Bloomberg Economics has lowered its global GDP growth forecast for 2020

from 3.3 per cent before the virus hit, to 2.6 per cent as of March 10. “Not a global recession,” says the report, “but a significant economic hit with potential for localized contractions in certain markets.”

Central bank rate cuts and the lack of other investment options means that the world is likely to remain in a low-interest-rate environment. This is good for clean energy, since the cost of debt is a significant factor in project levelized costs. However, the collapse in stock markets will make it challenging for some investors to raise equity.

Distracted policy makers

BNEF says the one way in which Covid-19 will affect solar, wind and storage is by slowing down legislative processes as parliaments are shut down or work on emergency disease control measures. This hiatus will affect build in 2021.

For example, in China a solar mega-auction was pushed back from May to June 2020, with commissioning deadline in 2021. This project may be endangered if the outbreak flares up again.

Also, Poland is in the middle of the legislative process for its offshore wind law. It is expected to detail an auction design, timeline and who is responsible for constructing the transmission to shore. As of January it was expected to be approved in 1H 2020. We expect the first project in Polish waters to be online by 2026.

Solar

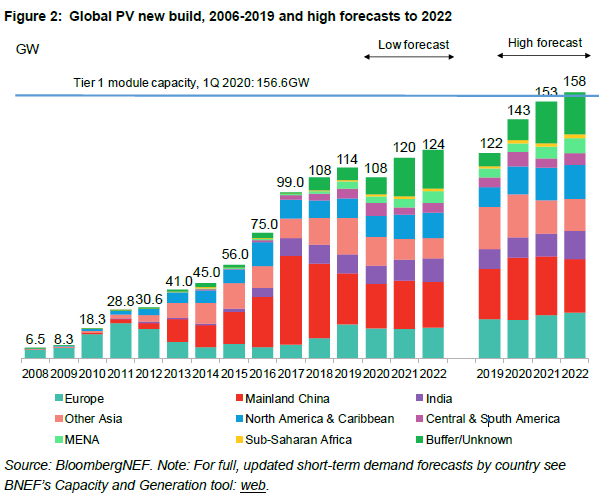

BloombergNEF’s solar team has cut its solar demand forecast for 2020 from 121-152 GW to 108-143. This could make 2020 the first down year for solar capacity addition since at least the 1980s.

The biggest change is that we have reduced our China demand estimate from 36.3-43.7 GW to 26.2-36.7 GW for 2020, mainly due to policy changes in response to Covid-19.

The US forecast was cut by 500-600 MW to reflect slower residential rooftop uptake, although the US Energy Information Agency has released 2019 total installation figures of 8.81 GW(AC), which is about 11.2 GW(DC), a little higher than the preliminary estimates.

Wind

BloombergNEF sees considerable downside risk to the forecast for 2020 wind installations from the 75.4 GW forecast in December 2019, however they still expect this year to be a record year for new wind installations.

The size of the drop will depend on how quickly Chinese suppliers ramp-up to full production as staff slowly return from isolation, and the severity of delays to already-tight construction schedules from late component deliveries in the US.

Markets most at risk of missing 2020 expectations are China and the US, where end-of-year subsidy deadlines have driven a rush to build. Tight construction schedules leave little flexibility to accommodate later deliveries of components. It is not yet clear if the respective governments will be lenient on projects that are pushed into 2021.

A prolonged outbreak could put the maintenance of wind farms at risk, ultimately lowering availability and reducing output.

Electric vehicles

The BNEF report states that the global auto market “is very sensitive to macroeconomic conditions and will be hit hard by the coronavirus and any economic contraction that accompanies it”.

It says early data from the main markets in Asia shows a drop in vehicle sales of 44 per cent for China and 18 per cent for Korea, two of the hardest hit countries. “Global auto sales have been falling for the last two years, and this year we expect the single largest drop since the 2008 financial crisis,” said BNEF. “We expect global automakers to slash sales forecasts

as the full extent of the supply and demand disruptions become clear.”

Battery manufacturing

BNEF says that, as with solar, it expects battery demand to be impacted by Covid-19 more than supply. “The battery industry has excess capacity, increased automation and multiple manufacturing hubs, so most manufacturers are in a strong position to weather the storm. Lockdowns in China reduced output for a short period at some battery plants in February. Once restrictions were lifted, excess capacity in the industry meant companies could increase output to compensate for the closure.”

For battery manufacturers, BNEF says the biggest impact will come from changes to downstream demand. “We have already downgraded our forecast for EV adoption in China. In an optimistic scenario, battery demand there will be 3 GWh lower in 2020 than initially forecast, and 9 GWh lower in a pessimistic scenario. If similar patterns around vehicle purchasing emerge in the rest of the world, global battery demand in 2020 could be tens of GWh lower than expected.

On Saturday, Francesco La Camera, Director-General of the International Renewable Energy Association (IRENA), said in a statement: “The outbreak of COVID-19 threatens global supply chains in many sectors and is therefore likely to have an impact on renewable energy. The severity and duration of both situations remains seen.

“What is critical to understand, is that the long-term planning horizons involved, and the momentum that currently exists in the energy transformation, means neither low oil prices nor COVID-19 will interrupt or change our path towards decarbonisation of our societies and towards the achievement of the sustainable development goals.”

13 March 2020

Pei